General Motors (GM) has been strategically signing a series of raw material supply deals for electric vehicle (EV) batteries over the past few years. The majority of these supply agreements involve companies with operations in North America, highlighting GM’s commitment to localizing its battery manufacturing processes. Multiple suppliers in Canada play a crucial role in GM’s efforts to make EV batteries more cost-effective.

Last year, GM made a significant move towards localizing battery manufacturing for its EVs by operating two battery gigafactories in the United States in partnership with LG Energy Solution, a Korean company. The automaker’s goal is to reduce its dependence on Chinese-dominated battery supply chains and establish a fully North American supply chain for EV batteries. By having more control over battery materials, companies can influence the cost of their EVs, similar to the competitive pricing seen in Chinese EVs. GM aims to follow this path to make EVs more affordable and less susceptible to geopolitical factors.

In a recent episode of the Core Memory Podcast, GM Battery Engineer and Business Planning Manager Andy Oury discussed the company’s plans to streamline its battery supply chain while lowering costs without compromising the range or performance of future EVs. Oury stated that by the end of the decade, GM’s level of battery manufacturing independence will be significantly different from the current scenario.

GM has been actively securing supplies of raw materials for battery cells within North America through a series of sourcing deals. These agreements cover materials such as lithium and cathode active materials (CAM) like nickel, cobalt, manganese, and aluminum. Many of these deals were signed following the Inflation Reduction Act during the Biden administration, which imposed strict sourcing requirements for EV tax credits.

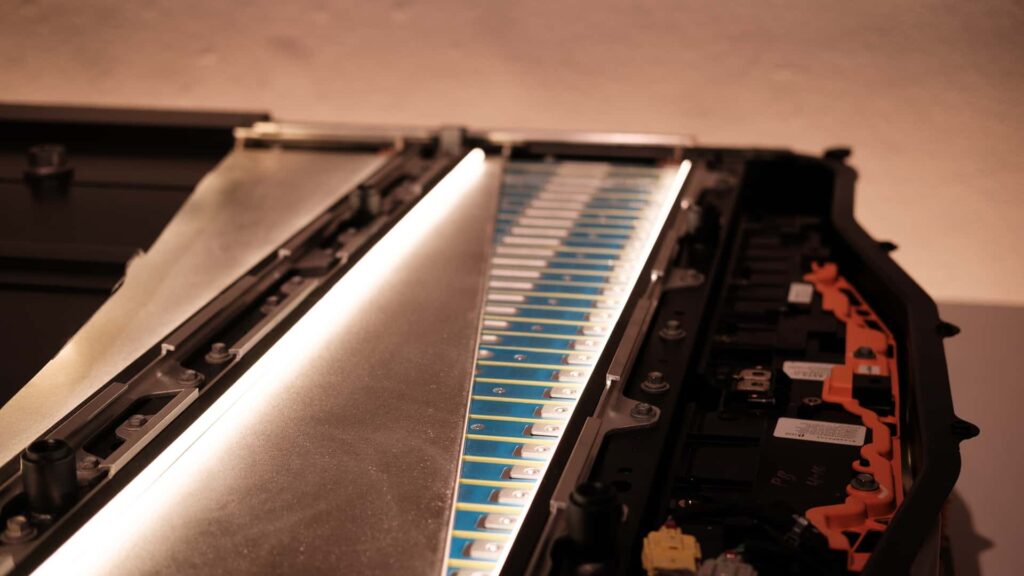

Currently, GM utilizes nickel manganese cobalt aluminum (NMCA) batteries in a pouch format across its EV lineup, from the affordable Chevy Equinox EV to the premium GMC Hummer EV. The company is also preparing to introduce a new lithium manganese-rich (LMR) chemistry that reduces the use of costly nickel and cobalt while increasing manganese content. This new battery chemistry is expected to offer a similar cost to low-cost lithium iron phosphate (LFP) packs while providing a range comparable to traditional NMC batteries.

GM plans to source manganese from the U.S. branch of Australian mining company Element 25, with processing taking place at Element 25’s Louisiana plant. The agreement covers a substantial amount of manganese sulfate annually, sufficient to power approximately 1 million EVs in North America. Additionally, GM has partnered with Brazilian mining giant Vale to supply nickel from its Canadian operations, starting in 2026. Although the second phase of Vale’s project in Quebec was paused due to projected changes in U.S. EV demand, the partnership remains crucial for GM’s battery supply chain.

Overall, GM’s strategic sourcing deals and partnerships with suppliers in North America reflect the company’s commitment to localizing its EV battery manufacturing processes, reducing costs, and ensuring a stable supply chain for its electric vehicles. This is about making electric vehicles that people want to buy,” said GM CEO Mary Barra during the GM Forward Event 2025, where these announcements were made. The shift towards localizing battery production and sourcing key materials is part of GM’s broader strategy to accelerate its transition to electric vehicles and reduce costs to make EVs more accessible to consumers.

Vale’s plans to begin nickel production in 2026 align with the growing demand for nickel in the electric vehicle industry, as it is a key component in batteries. In the meantime, the company can rely on existing Canadian plants to meet demand. GM’s partnership with Vianode for synthetic graphite and Lithium Americas for battery-grade lithium carbonate further solidifies its commitment to sourcing materials locally and ensuring a sustainable and efficient supply chain for its electric vehicles.

By focusing on reducing costs at every stage of the battery production process, GM aims to make electric vehicles more affordable and appealing to a wider range of consumers. The use of low-cost LFP and LMR cells in its upcoming vehicles demonstrates GM’s commitment to innovation and sustainability in the electric vehicle market. With these strategic partnerships and investments, GM is well-positioned to lead the charge towards a cleaner and more sustainable transportation future.