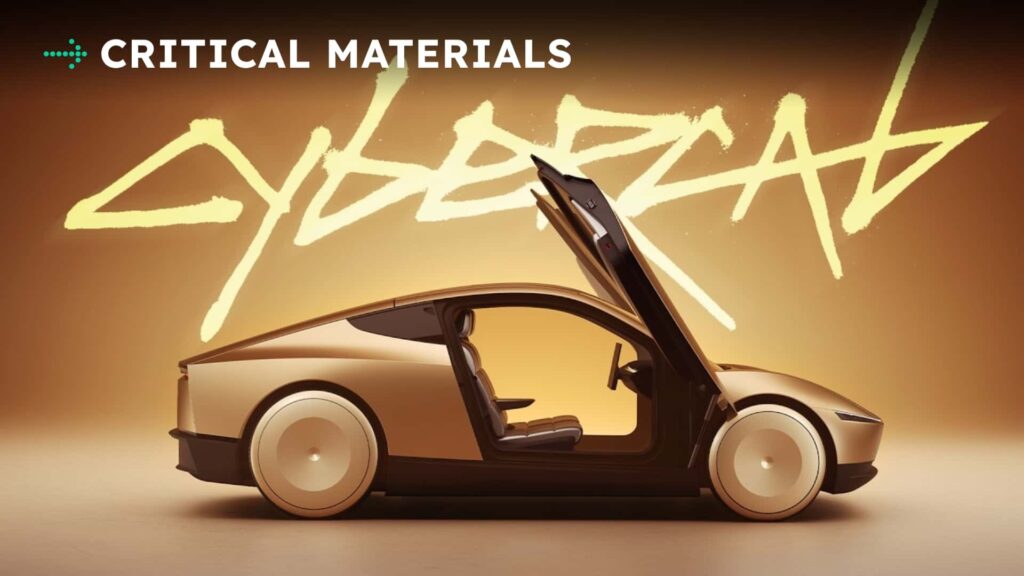

Tesla’s CEO Elon Musk has made it clear that the early production phase of the Cybercab and Optimus robot will be slow and challenging. In a recent post, Musk warned that the new products, which are crucial to Tesla’s future success, will face hurdles due to their complexity and novelty.

The Cybercab, Tesla’s autonomous robotaxi, and the Optimus humanoid robot are both innovative machines with new parts, processes, and assembly steps. Musk emphasized that the speed of production ramp-up is directly related to the number of new elements involved in the manufacturing process. As a result, the initial production phase will be “agonizingly slow,” according to Musk.

The success of these new products is essential for Tesla’s future growth and profitability. The Cybercab is envisioned as a solution to global transportation challenges, particularly once autonomous driving technology is fully realized. On the other hand, the Optimus robot is expected to be a game-changer for Tesla, potentially generating significant revenue for the company.

Musk has drawn parallels between this upcoming production phase and the challenging period of ramping up Model 3 production, which nearly bankrupted the company. Investors have high expectations for Tesla’s new products, and the company’s valuation is heavily dependent on their success. Tesla’s $1.39 trillion valuation is closely tied to the potential of its self-driving technology and humanoid robots, in addition to its electric vehicle sales.

While the initial production challenges may be daunting, Musk remains optimistic about the long-term prospects of the Cybercab and Optimus robot. He believes that these products have the potential to revolutionize industries and unlock new economic opportunities. As Tesla prepares to navigate this challenging ramp-up phase, all eyes will be on the company’s ability to overcome obstacles and deliver on its ambitious vision. uary 21, in the Denver District Court by Colorado Automobile Dealers Association and 11 franchise dealer members, alleges that the Department of Revenue’s Motor Vehicle Dealer Board acted unlawfully in granting Scout Motors a license to operate in the state. The lawsuit seeks to invalidate the license and prevent Scout from operating in Colorado.

The dealers argue that the Motor Vehicle Dealer Board did not properly consider the impact of allowing Scout to sell directly to consumers and did not give dealers an opportunity to provide input on the matter. They also claim that Scout does not meet the statutory requirements to qualify for a direct-sales license.

This is not the first time that Scout has faced legal challenges to its direct-to-consumer sales model. The company is currently embroiled in a similar lawsuit in California, where dealers have raised similar concerns about the legality of Scout’s operations.

Volkswagen has expressed its support for Scout’s direct-sales model, arguing that it will help the company reach new customers and streamline the car-buying process. However, the legal challenges from dealers could pose a significant hurdle for the brand as it seeks to establish itself in the U.S. market.

As the legal battle continues to unfold, it remains to be seen whether Scout Motors will be able to overcome these challenges and successfully launch its electric and range-extended vehicles in the U.S. market.

100%: GM’s BrightDrop To Ramp Up Production With New Plant

Photo by: BrightDrop

GM’s BrightDrop division, which focuses on electric delivery vehicles, is set to ramp up production with the opening of a new plant in Michigan. The plant, located in Lansing, will produce the BrightDrop EV600 electric delivery van, which is designed to help logistics companies reduce emissions and improve efficiency.

The EV600 has already begun deliveries to customers, and the new plant will allow GM to increase production to meet growing demand for electric delivery vehicles. The plant is expected to create hundreds of new jobs in the Lansing area and will play a key role in GM’s efforts to transition to electric vehicles.

Automotive News provides more details on the new plant:

The Lansing plant, which previously produced the Chevrolet Traverse and Buick Enclave crossovers, will have capacity to build more than 25,000 EV600 vans annually. The plant is the first of two that GM plans to open for BrightDrop. A second plant in Canada is set to open later this year and produce the EV410 electric light commercial vehicle.

The opening of the new plant marks a significant milestone for GM’s electrification efforts and demonstrates the company’s commitment to sustainable transportation solutions. With the EV600 already making waves in the delivery industry, GM is poised to lead the way in electric delivery vehicles and help drive the transition to a cleaner, greener future.

This recent lawsuit in the Denver District Court has brought to light some intriguing issues surrounding Scout, an electric vehicle manufacturer, and its parent company, the Volkswagen Group. The case revolves around the Department of Revenue Division of Motor Vehicles’ interpretation of Colorado law, which the dealers argue was incorrectly applied in Scout’s favor.

The crux of the dealers’ argument is that Scout and VW Group are essentially one entity, meaning that VW is competing with its own franchised dealers, which is a violation of dealer laws. This legal battle has implications not just for Scout’s business model but also for the broader landscape of electric vehicle manufacturers and traditional dealership networks.

One of the key points of contention in the lawsuit is Scout’s decision to sell extended-range electric vehicles, which are essentially electric vehicles with gas-powered generators that can charge the battery. The lawsuit argues that Scout’s extended-range system qualifies as a plug-in hybrid system rather than a pure electric vehicle, which would disqualify the brand from certain exemptions in Colorado law meant for EV-only brands like Rivian and Lucid.

Despite the legal challenges, Scout has managed to avoid any negative outcomes so far and is moving forward with its plans to produce the Terra pickup and Traveler SUV in 2027 at a new factory in South Carolina. The company’s commitment to innovation and sustainability in the electric vehicle space is clear, but the legal battle over its business model highlights the complexities of navigating the traditional dealership model in an era of rapid technological advancement.

In a related development, Tesla owners have been offered a unique opportunity by an insurance company to receive a discount of up to 50% on their policies if they use Tesla’s Full Self-Driving (FSD) feature. This offer raises interesting questions about the intersection of technology, insurance, and consumer behavior, showing that the future of transportation is not just about the vehicles themselves but also the services and policies that surround them.