Elon Musk’s private companies are on track for significant valuation increases, as investors continue to show strong support for the ventures of the world’s richest man. According to reports from the Financial Times, two of Musk’s companies are set to see massive jumps in valuation.

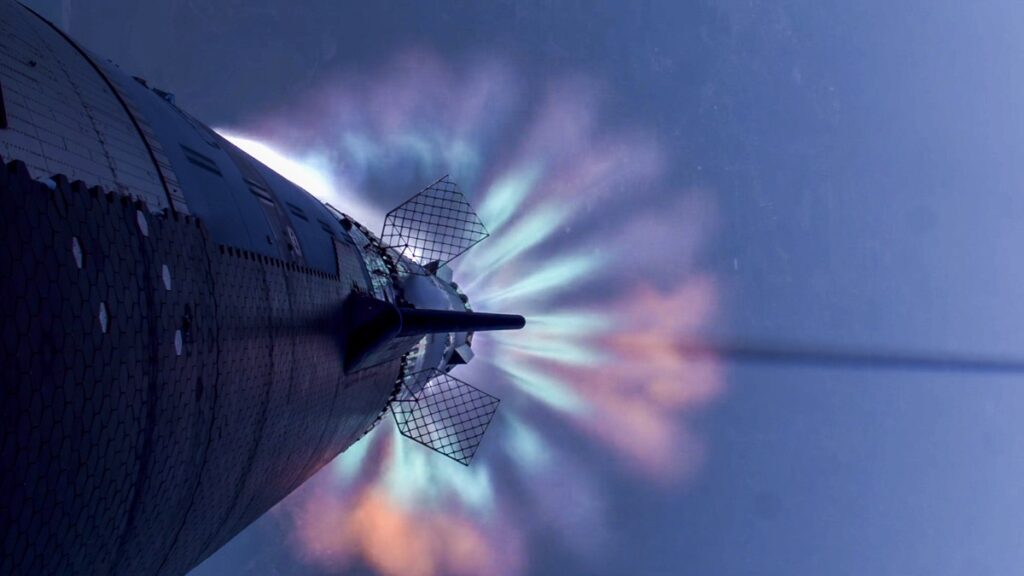

SpaceX, the largest private company in the U.S., is planning to sell shares in December at $135 each. This move would raise its valuation to over $250 billion, up from $210 billion earlier this year. The next frontier for SpaceX is the ambitious goal of reaching Mars, which is being funded by the rapidly expanding Starlink satellite internet constellation.

Musk’s AI startup, xAI, has also seen a major increase in valuation. The company recently raised $5 billion, valuing it at $45 billion—almost double what it was worth just a few months ago. xAI is known for developing Grok, an AI tool that competes with popular systems like ChatGPT. Additionally, the company is working on Colossus, one of the world’s largest supercomputers, located in Memphis.

Discussions for the recent funding round for xAI began just last month, and all the shares were quickly snapped up by existing investors. There are already talks of another funding round for xAI early next year, which could potentially value the company at $75 billion.

Musk’s recent ties to former President Donald Trump may also be playing a role in the success of his businesses. Trump named Musk and biotech entrepreneur Vivek Ramaswamy to head a new “government efficiency” department aimed at cutting bureaucracy. Since Trump’s election win on November 5, Tesla’s stock price has surged by nearly 30%. Musk is seen as a close adviser to Trump, which some believe could benefit SpaceX in securing government deals.

Overall, Musk’s companies are poised for significant growth and success in the coming months, with SpaceX aiming for Mars and xAI making waves in the AI industry. Investors and supporters continue to show strong confidence in Musk’s vision and his ability to push the boundaries of innovation.