- Electric Vehicle Sales Expected to Skyrocket by 2030

- Rising Demand for EVs Could Impact Lithium Supply

- Exploring Reuse, Recycling, and Alternative Chemistries to Alleviate Supply Chain Pressure

A surge in global demand for electric vehicles is projected to strain raw material supplies by the end of the decade, as per a recent analysis by McKinsey & Company.

The analysis forecasts a sixfold increase in EV sales, from around 4.5 million units in 2021 to 28 million units by 2030. However, concerns arise regarding the ability of raw material producers to meet this escalating demand.

While McKinsey anticipates a boost in lithium supply through advanced mining technology, the surge in demand from battery manufacturers could outpace this growth. Currently, battery suppliers account for 80% of global lithium consumption, a figure set to soar to 95% by 2030 according to McKinsey.

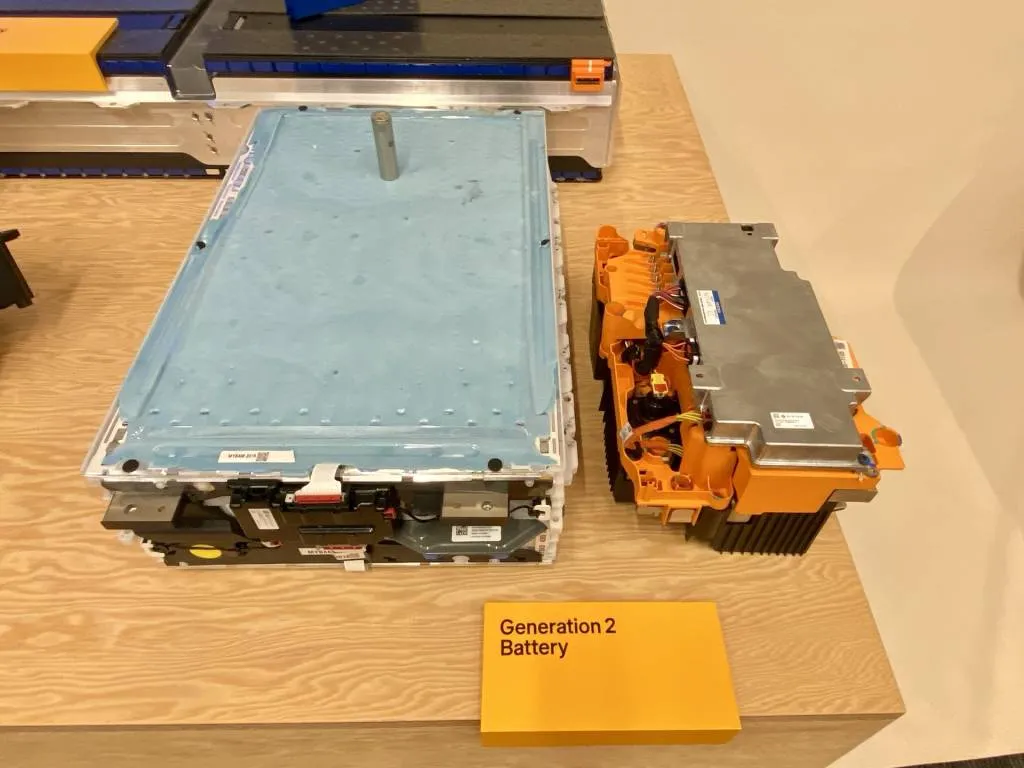

Stack of Rivian battery cells

If the demand for NMC-chemistry EV batteries continues to rise, a nickel shortage could emerge despite increased mining activities. McKinsey notes that the battery industry competes with the steel sector for nickel, with both expected to escalate consumption through the decade.

McKinsey acknowledges the potential shift towards LFP chemistry, which could alter the supply dynamics if production of LFP battery cells rises substantially.

Efforts by the European Union and the U.S. to boost domestic battery production through the cultivation of additional raw material sources could impact the supply chain. However, policy changes by the incoming administration may disrupt these plans and jeopardize a potential cost advantage over China in battery production.

Rivian Gen 2 battery pack

Various companies are exploring options such as reusing and recycling battery materials, as well as experimenting with alternative chemistries beyond LFP. These initiatives could potentially relieve some of the pressure on the primary raw material supply chain before the decade concludes.

While McKinsey’s analysis presents a positive outlook on battery raw material demand, other viewpoints differ. Goldman Sachs, for instance, predicts a 50% drop in EV battery prices by 2026 due to declining costs of raw materials like lithium and cobalt. This disparity in forecasts underscores the uncertainty surrounding the future trajectory of the industry.