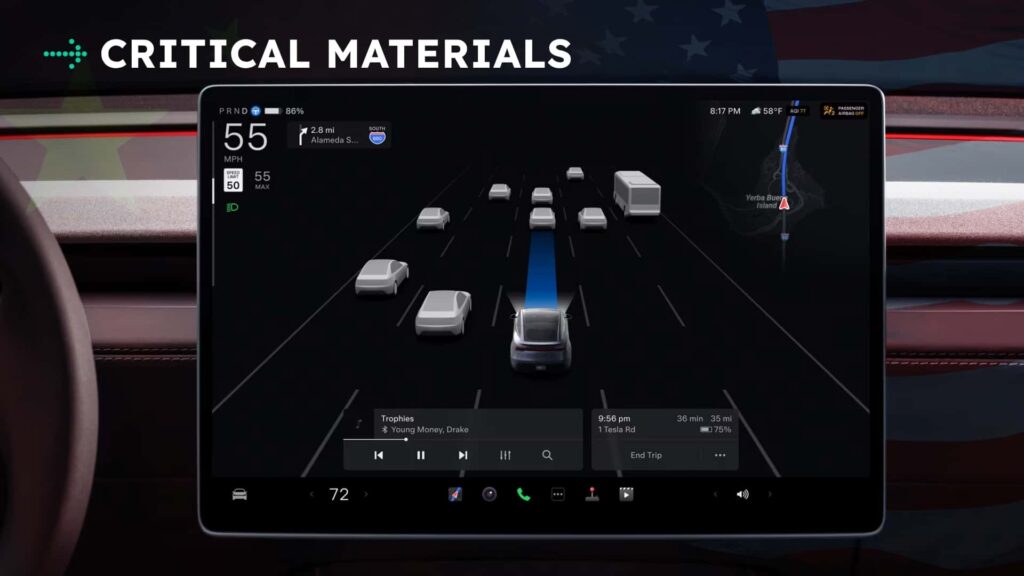

China is playing a strategic game with Tesla’s Full Self-Driving software approval as a potential bargaining chip in the escalating trade war with the U.S. The approval of Tesla’s FSD software in China has been delayed indefinitely, with reports suggesting that it could be used as leverage in trade negotiations. This move could have significant implications for Tesla’s operations in China and its global revenue.

On the other hand, U.S. President Donald Trump is considering imposing new tariffs on automobiles, with a proposed start date of April 2. This decision comes amidst a series of trade actions taken by the Trump administration, causing uncertainty and concern within the auto industry. The potential impact of these tariffs on car purchases, repairs, and insurance is causing apprehension among consumers and manufacturers alike.

Meanwhile, Chinese automaker BYD is gearing up to challenge Europe’s luxury brands in the EU market. With plans to introduce its premium marques, Denza and Yangwang, BYD aims to disrupt the dominance of German luxury automakers in the region. By offering high-tech EVs, PHEVs, and luxury cars at competitive prices, BYD is positioning itself as a formidable competitor in the European market.

As China’s automotive industry continues to expand globally, German luxury brands face increasing competition from Chinese manufacturers. The challenge for German automakers lies in competing with Chinese brands that offer advanced technology, striking design, and impressive performance. How the German luxury brands respond to this competition will determine their success in the evolving automotive landscape.

In conclusion, the dynamics of the global automotive industry are shifting, with China emerging as a key player in challenging the dominance of traditional automotive powerhouses. The strategic moves by China, the U.S., and Chinese automakers like BYD are reshaping the competitive landscape and pushing established brands to innovate and adapt to stay ahead in the evolving market.