Tesla’s European Sales Slump Continues

Switching gears to the electric vehicle sector, Tesla’s European sales have hit a bit of a rough patch. According to Reuters (via Automotive News), Tesla’s sales have fallen by 29% in May compared to the previous month. This drop comes as competition heats up in the EV market, with traditional automakers like Volkswagen and Ford releasing their own electric models to compete with Tesla.

Despite the drop in sales, Tesla still remains a dominant force in the EV market, with its Model 3 being one of the best-selling electric cars in Europe. However, with increased competition and supply chain issues affecting production, Tesla may face challenges in maintaining its market share in the region.

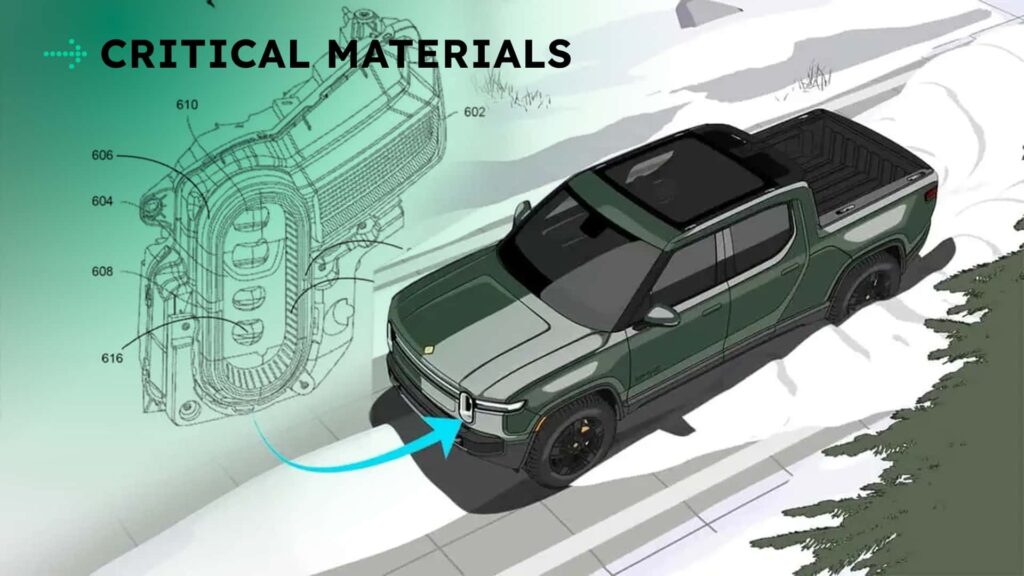

CATL Looks to Escape EV Knife-Fight in China

Finally, Chinese battery giant CATL is looking to avoid getting caught in the crossfire of the ongoing electric vehicle “knife-fight” in China. According to Reuters (via Automotive News), CATL is exploring options to increase its prices in order to avoid being dragged into a price war with other battery manufacturers in China.

As demand for electric vehicles continues to rise in China, battery manufacturers are facing pressure to lower prices in order to secure contracts with automakers. However, CATL is looking to maintain its premium pricing strategy in order to protect its profit margins and ensure the quality of its products.

Overall, the electric vehicle market continues to evolve rapidly, with challenges and opportunities for both automakers and suppliers. As the industry navigates issues such as regulatory standards, sales fluctuations, and pricing pressures, innovation and adaptation will be key to success in the ever-changing automotive landscape.

That’s it for today’s edition of Critical Materials. Stay tuned for more updates on electric vehicles, technology, and innovation in the automotive industry.

. Tesla’s Model 2. With a price tag of around $25,000, this compact electric vehicle aims to bring Tesla’s technology to a broader audience. However, with the current slump in European sales, will the Model 2 be enough to turn things around for Tesla?

The European market is crucial for Tesla’s success, as it represents a significant portion of global EV sales. With competition heating up from both traditional automakers and Chinese brands, Tesla needs to regain its footing in Europe to maintain its position as a leader in the EV market.

One of the key factors contributing to Tesla’s sales decline in Europe is the lack of new models. While the Model Y was expected to boost sales, it has yet to make a significant impact. In contrast, Chinese brands are rapidly expanding their presence in Europe with a range of compelling electric vehicles.

Elon Musk’s controversial statements and political involvement have also alienated some customers, further impacting Tesla’s sales. As other automakers invest heavily in electrification, Tesla faces increasing competition in the EV market.

Despite these challenges, Tesla remains optimistic about its future. The upcoming launch of the Model 2 is seen as a critical opportunity to attract new customers and regain market share in Europe. With its affordable price point and Tesla’s reputation for innovation, the Model 2 could be a game-changer for the company.

In conclusion, Tesla’s recent sales slump in Europe highlights the competitive nature of the EV market. As the industry continues to evolve, Tesla will need to adapt and innovate to stay ahead of the competition. The success of the Model 2 could be a turning point for Tesla, signaling a new chapter in the company’s journey towards sustainable transportation.

China’s EV market is experiencing intense competition, with over 100 EV brands fighting for sales by slashing prices. This cutthroat environment is eroding margins and leading to concerns about sustainability. Amidst this chaos, CATL, the world’s largest battery maker, is prioritizing global expansion to escape the brutal price war in its home market.

CATL is renowned for its expertise in battery manufacturing, a fact highlighted by its founder’s criticism of Elon Musk’s battery-making abilities. Recognizing the need to diversify beyond China, CATL is focusing on expanding its presence internationally. This strategic move aims to shield the company from the hyper-competitive landscape within China.

According to a report by Bloomberg, CATL’s Chief Manufacturing Officer Ni Jun stated that overseas expansion is the company’s top priority. Ni emphasized the detrimental effects of irrational competition on the industry, echoing sentiments expressed by executives from other Chinese EV manufacturers like BYD. Stella Li, Executive Vice President of BYD, described the ongoing EV price war as extreme and unsustainable.

While CATL has been gradually expanding outside China in recent years, global trade restrictions have posed challenges. These constraints, such as limitations on EV tax credits for companies using specific raw materials, have hindered CATL’s expansion efforts. As a result, the company has opted to collaborate with U.S. automakers to license its technology instead.

Ni highlighted the valuable lessons learned from CATL’s overseas ventures, such as the realization that land costs, labor dynamics, and operational challenges vary significantly across regions. For instance, CATL’s new factory in Germany underscored the importance of adapting to diverse market conditions and operational nuances in international expansion.

But it’s not just about the side mirrors. Outdated regulations in the U.S. are holding back advancements in automotive technology across the board. Take, for example, the case of Contemporary Amperex Technology Co. Limited (CATL), a Chinese battery manufacturer that is looking to expand globally.

When Ni, the founder of CATL, tried to operate the company in the same way it did in China, he quickly realized that the regulations and requirements in other countries, especially the U.S., were vastly different. This forced him to adapt and change his approach, leading to the realization that CATL couldn’t operate the same way if it wanted to go global.

This lesson, while potentially expensive, was crucial for CATL’s success in the international market. It highlighted the importance of understanding and complying with regulations in different countries, especially when it comes to the automotive industry. Ni’s experience serves as a valuable reminder that companies need to be flexible and adaptable in order to thrive in a global market.

So, are outdated regulations holding back cars in the U.S.? The answer seems to be yes, at least in some cases. As technology advances and companies look to expand globally, it’s important for regulations to keep up in order to foster innovation and growth in the automotive industry.

Perhaps it’s time for a reevaluation of existing regulations and a push for more flexible and forward-thinking policies that will allow companies like CATL to continue to thrive and innovate on a global scale.